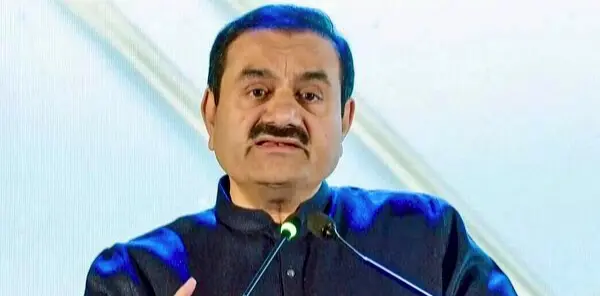

New York: Indian infrastructure tycoon Gautam Adani, in his first legal response in the Securities and Exchange Commission bribery case, has urged a US federal court to defer any ruling on service of summons amid stalled diplomatic channels. The filing, dated January 23, comes after 14 months of procedural deadlock in the case in which Adani and nephew Sagar have been accused in a $265 million bribery scheme.

The SEC’s civil complaint, filed on November 20, 2024, alleges Gautam Adani, Sagar Adani, and others orchestrated bribes to Indian officials for solar power contracts while misleading US investors during a $175 million bond offering by Adani Green Energy. Major accusation include false statements on anti-corruption measures, defrau

ding investors who poured billions into Adani entities.

Service attempts via India’s Ministry of Law on two separate occasions hit roadblocks – first rejected for lacking proper seals, second on procedural grounds. This prompted the SEC on January 21 to seek court approval for email summons under Hague Convention exceptions. Adani’s counsel countered in the Brooklyn federal court filing, arguing the SEC’s alternative methods (email, social media) risk due process violations and premature jurisdiction assertions. They requested deferral until diplomatic service exhausts, citing international comity and India’s sovereignty.

Adani Group vehemently denies the “baseless” charges, vowing “all possible legal recourse.” Shares in Adani firms dipped 2-5% post-filings, amid US-India trade tensions under President Trump.

Legal experts view Adani’s move as tactical delay, buying time for defense prep or political leverage. Magistrate Judge James Cho paused proceedings earlier; a hearing looms. The case, parallel to a sealed Department of Justice criminal probe, tests cross-border enforcement amid Adani’s $66 billion Maharashtra investments.