Mumbai: A same-sex couple has moved the Bombay High Court challenging the Income Tax Act’s differential treatment on the taxation of gifts between partners.

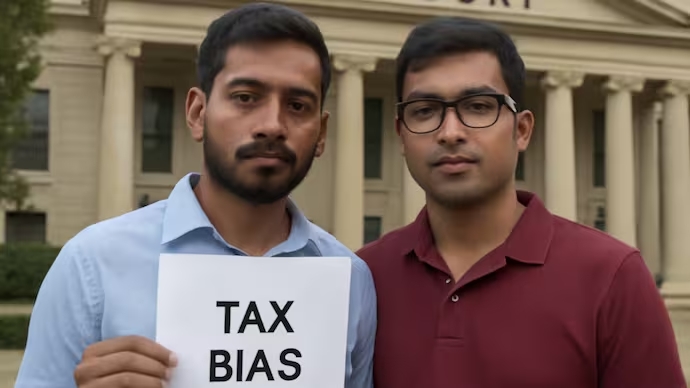

The case, filed by homemaker Payio Ashiho and his partner Vivek Divan, a former lawyer at the UN, was admitted by a bench comprising Justices B P Colabawalla and Firdoush Pooniwalla.

The bench issued a notice to the Attorney General because of the constitutional dimensions raised, reported The Economic Times.

The petitioners, represented by Advocate Dr Dhruv Janssen-Sanghavi, have argued that the existing law provides unequal economic treatment to same-sex couples compared to heterosexual couples.

Under Section 56(2)(x) of the Income Tax Act, any money, property, or asset received without adequate consideration, valued at over Rs 50,000, is taxed as ‘income from other sources’. However, the fifth proviso to the section exempts such gifts when received from ‘relatives’, including ‘spouses’. The term ‘spouse’ is not separately defined in the Act.

The couple is not seeking validation of same-sex marriage, but has sought directions from the court to declare the term ‘spouse’ in the tax provisions be interpreted to include long-term same-sex partners.

Such a provision will would allow them to claim tax relief and protect them from reassessments or penalties.

It’s an important case as it could have broader implications on the rights of LGBTQIA+ community, especially in areas like property inheritance, investments, and economic autonomy.

The Supreme Court decriminalised same-sex relationships in 2018, but refused to extend recognition under the Special Marriage Act in 2023.