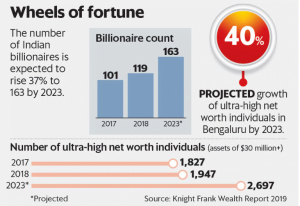

Even as the rupee continues to depreciate against the dollar and elections are keeping business optimism low, a global study has said individual assets and wealth creation would continue to grow at a rapid pace. So much so that India is set to add 44 new billionaires in the five years to 2023, with the IT capital Bengaluru producing most of them.

1. Bengaluru will see a 40 per cent growth in billionaire population, making it the first among the top five “future cities in the world”. The others are Hangzhou, Stockholm, Cambridge and Boston.

2. According to Knight Frank’s latest Wealth Report, the findings of which have been published by Live Mint, the number of Indian billionaires is expected to rise 37 per cent to 163 by 2023, beating the global and regional averages.

3. The number of ultra-high net worth individuals (UHNWIs), or those with net assets of $30 million or more, is expected to grow 39 per cent to 2,697. India will be followed by the Philippines (38%) and China (35%). Bengaluru will lead the growth of UHNWIs in India, it adds.

4. Globally, 2019 will also see the number of high net-worth individuals exceed 20 million for the first time.

5. Overall, Asia remains the biggest hub for billionaires, with their number set to rise to more than 1,000 by 2023, accounting for over a third of the world’s billionaire population of 2,696, adds the report.

6. “Despite softening momentum in the region’s economies, growth prospects in Asia remain favourable in the medium term,” said Nicholas Holt, head of research, Knight Frank Asia Pacific. “While China’s economy is expected to slow, emerging markets such as India and the Philippines will deliver some of the strongest growth over the coming years.”

7. Around 24 per cent of Indian UHNWIs has property investments, excluding first and second homes, outside India, up from 21 per cent in the previous year.

8. Indian buyers are typically attracted by education opportunities for their children, new business ventures and stable investment returns. While London, Melbourne and Dubai draw significant interest, other markets such as Cyprus, Malaysia and Sri Lanka are also popular with Indian investors.