New Delhi: In what could be the first major casualty of India’s new rules for foreign investments from China, tech giant Alibaba Group has reportedly put on hold plans to invest in Indian companies for at least six months.

However, it has no plans to reduce its stake or exit investments, Asiatimes reported.

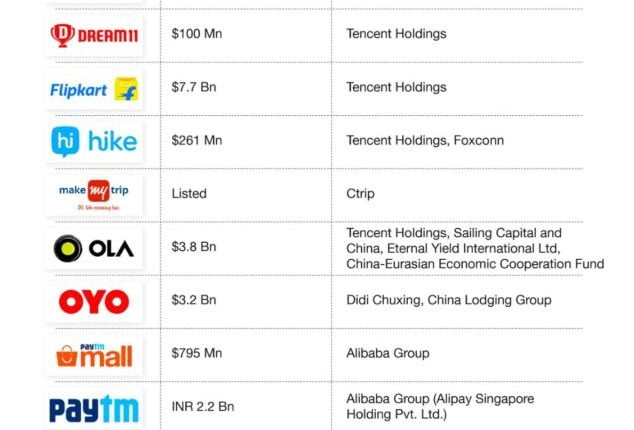

This move could affect fundraising plans of Indian startups such as payments platform Paytm, restaurant aggregator and food delivery service Zomato and e-grocer BigBasket. Alibaba and its subsidiaries, Alibaba Capital Partners and Ant Group, have invested more than $2 billion in Indian companies from 2015.

Also Read: Govt Approval Must For All FDIs From China & Other Neighbouring Countries

Reportedly, in its latest initial public offering (IPO) prospectus, ANT Group detailed the impact of the Indian FDI rule changes on its investments in Paytm and Zomato. It claimed that the new foreign investment rules had led to “further evaluation of the timing” of the additional investment in Zomato.

Ant Group had earlier flagged concerns about investing in India while filing for an IPO. It said the change in foreign investment rules had hampered its investment in Indian startups.

Chinese firms are also being barred from taking up various infrastructure projects, and the participation of Huawei Technologies and ZTE in the forthcoming 5G trials is in doubt. Huawei’s clients include Bharti Airtel and Vodafone Idea, and ZTE supplies gear to state-owned Bharat Sanchar Nigam Limited.

Also Read: Amazon, Flipkart Flouting FDI Norms: CAIT