Interoperable Internet Banking System To Kick Off This Year; Know More About It

New Delhi: India will get a new Internet banking system sometime this year.

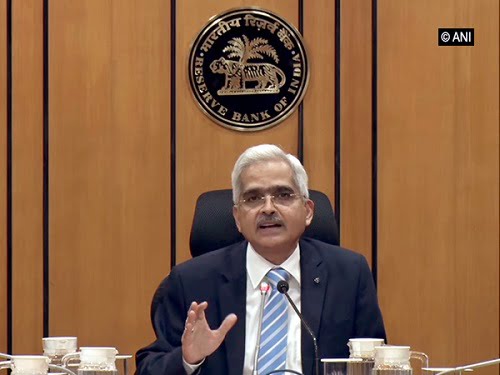

Reserve Bank of India (RBI) governor Shaktikanta Das announced on Monday that an interoperable payment system for internet banking is expected to be introduced in 2024.

This system will enable faster settlement of funds for merchants.

Internet banking is a favoured channel for payments such as income tax, insurance premiums, mutual funds and e-commerce transactions. But presently, transactions processed through Payment Aggregators (Pas) lack interoperability, requiring banks to individually integrate with each PA representing different online merchants.

“Given the multiple number of payment aggregators, it is difficult for each bank to integrate with each PA. Further, due to lack of a payment system and a set of rules for these transactions, there are delays in actual receipt of payments by merchants and settlement risks,” Das said while addressing the Digital Payments Awareness Week celebrations.

Considering these challenges, RBI’s Payments Vision 2025 is aimed at establishing an interoperable payment system for internet banking transactions. The country’s central bank has authorised NPCI Bharat BillPay Ltd (NBBL) to implement the interoperable system.

“We expect the launch of this interoperable payment system for internet banking during the current calendar year. The new system will facilitate quicker settlement of funds for merchants,” the RBI governor said.

Asserting that it will boost user confidence in digital payments, Das said, “As a regulator, we are committed to playing our part in India’s journey in digital payments.”

The RBI governor pointed out that UPI, the country’s flagship payment system, has emerged as the most widely discussed fast payment system, not only within India but globally as well. The UPI’s share in digital payments was nearly 80% in 2023. At a broader level, the volume of UPI transactions surged from 43 crore in Calendar Year (CY)-2017 to 11,761 crore in CY-2023.

Presently, UPI is handling approximately 42 crore transactions daily

Comments are closed.