Mumbai: The Reserve Bank of India (RBI) has exalted the government interventions and actions taken by financial regulators in maintaining market integrity and resilience during the ongoing COVID-19 pandemic.

RBI’s Financial Stability Report, released on July 24, reflects a combination of fiscal, monetary and regulatory interventions in response to coronavirus outbreak on an unprecedented scale, that has ensured normal functioning of financial markets, .

Important initiatives in the regulatory package for COVID-19 were inclusive of RBI’s liquidity measures along with regulatory measures of other financial regulators like Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDA), Pension Fund Regulatory and Development Authority (PFRDA) and Insolvency and Bankruptcy Board of India (IBBI).

Following liquidity measures were by adopted by RBI:

- To lower borrowing costs and revive growth prospects, the policy repo rate was brought down from 5.15 per cent on March 27, 2020 to 4 per cent on May 22, 2020. The Marginal Standing Facility (MSF) rate was reduced from 5.40 per cent to 4.25 per cent while the reverse repo rate under the Liquidity Adjustment Facility (LAF) was reduced from 4.90 per cent to 3.35 per cent.

- To enable better transmission of its monetary policy, RBI introduced Long Term Repo Operation (LTRO) under which RBI conducted term repos of one-year and three-year tenors at policy repo rate. Government securities market has remained resilient and the G-Sec yields have remained in tight range despite significant enlargement of government borrowing programme and increase in the borrowing limit of state governments.

Regulatory measures by SEBI aims to ensure orderly trading and settlement, effective risk management, price discovery and maintenance of market integrity. For mitigating the effects of the pandemic on the insurance sector, IRDAI simplified the quick claim settlement procedures for COVID-19 related cases, daily monitoring of life insurance claim settlements and utilization of digital and alternate modes for premium payments and various other services during the lockdown.

Other (excluding COVID 19 specific) important regulatory initiatives (November 2019-May 2020 were also highlighted in the report.

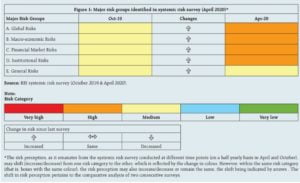

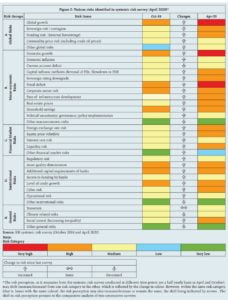

A Systemic Risk Survey was conducted in April-May 2020 to capture the perceptions of experts, including market participants, on the major risks faced by the financial system. According to the survey results, all major risk groups viz., global risks, risk perception on macroeconomic conditions, financial market risks and institutional positions were perceived as ‘high’ risks affecting the financial system.

Cyber risk appeared in the ‘high risk’ category for the first time since the inception of the survey.

“The MSME sector is affected because of lack of cash flows. Low demand, lack of manpower, stuck working capital and lack of capital may lead to further stress on employment. Real estate prices and cash flows on commercial real estate can undergo a major structural correction due to change in working patterns, which will lead to further pressure on real estate developers and lending. Potential margin compression in corporate bonds was seen as increasing leverage, leading to negative impact on credit metrics and consequent rating downgrade that can result in difficulties for refinancing of loans and raising capital,” said the survey.

Highlighting the challenges faced by the banking sector, the survey mentioned, “In the financial sector, the existing stock of non-performing assets in the banking system and bankers’ risk aversion remain big worries and impediments to economic growth. Despite measures taken by the Reserve Bank, transmission of liquidity and rate actions is still slow. Coupled with continued risk aversion, the flow of credit to the productive sectors (including NBFC & HFC) remains a challenge, Given that financial services are an integral and important constituent of the credit market, many participants opined that support from RBI would be important in the current environment.”

The central bank, however, warned about simmering global geopolitical tensions amid the pandemic as one of the major downside risks to global economic prospects. The FSR report also warned about the gross bad loans of Indian Banks are likely to spike up to 620 basis points to 14.7 per cent of total assets by the end of this financial year. “Macro stress tests for credit risk indicate that the GNPA ratio of all SCBs may increase from 8.5 per cent in March 2020 to 12.5 per cent by March 2021 under the baseline scenario; the ratio may escalate to 14.7 per cent under a very severely stressed scenario,” said the report.

Going forward, the major challenges include pandemic-proofing large sections of society, especially those that tend to get excluded in formal financial intermediation.