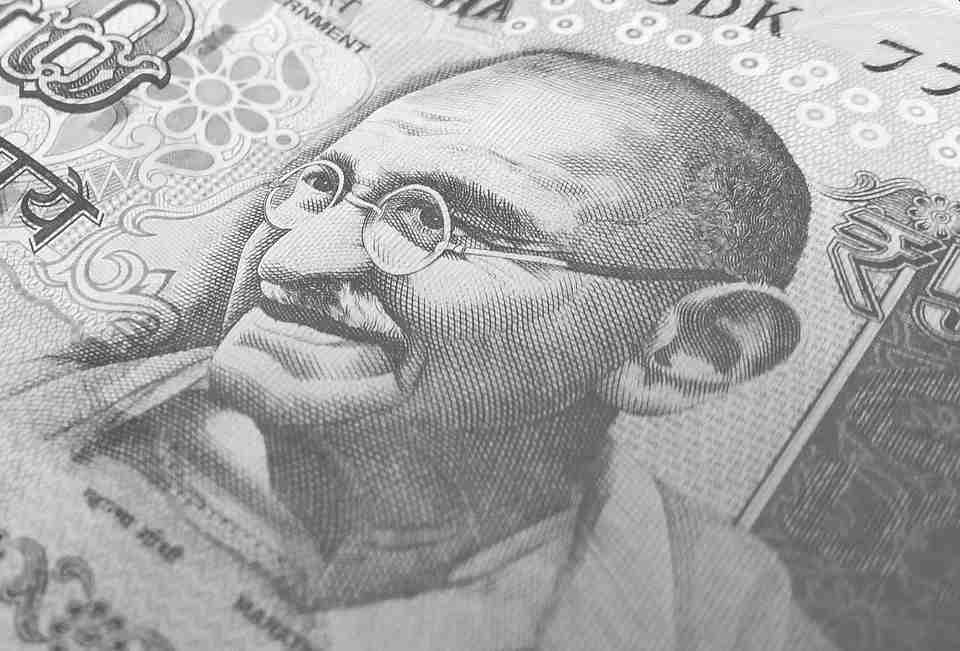

Rs 78 To One US Dollar: Indian Rupee Hits All-Time Low

New Delhi: The Indian rupee plummeted to an all-time low on Monday, breaching the 78-mark against the US dollar, breaking all previous records.

According to analysts, there are multiple factors behind the rupee falling to a lifetime low. “Some of the reasons behind this weakening include persistent Foreign Institutional Investors (FII) selling from past few months, rising bond yields, increasing oil prices and inflationary pressures for coming quarters,” Mohit Nigam, head — PMS, Hem Securities told News18.

“On the domestic front, persistent FII selling continues to dampen sentiment. FIIs have been net sellers for the eighth consecutive month, net offloading more than Rs 3.45 lakh crore since October 2021,” Prashanth Tapse, vice president (Research), Mehta Equities Ltd. was quoted as saying.

It has also been attributed to ‘more forceful’ Federal Reserve tightening expectations after US inflation climbed to four-decade highs pressurising the rupee, which has hit new lows repeatedly since March when it first touched the 77 per dollar mark, according to NDTV.

The basket of crude oil that India buys hit a decade high of $121 per barrel last week. International oil prices held near a 13-week high on June 9. The soaring global crude oil prices can also be attributed behind the falling rupee.

Comments are closed.