State Bank of India (SBI) will be reducing the average monthly balance in Savings Account from Rs 5000 to Rs 3000 from October 1.

The revised services for not maintaining the average monthly balance are as follows:

- Rs 10 plus GST if the average monthly balance falls short by 50 percent (that is Rs 1,500).

- Rs 15 plus GST if it falls short by more than 75 percent.

Account-holders in semi-urban branches will have to maintain an average monthly balance of Rs 2000 and those in rural branches will have to maintain Rs 1,000.

National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) will be free online but charged at branches. The charges are as follows:

NEFT up to Rs 10,000 – Rs 2 plus GST

NEFT above Rs 2 lakh – Rs 20 plus GST

RTGS between Rs 2 lakh to Rs 5 lakh – Rs 20 plus GST

RTGS above Rs 5 lakh – Rs 40 plus GST.

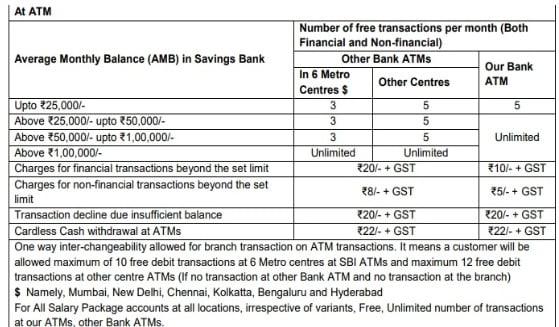

Cash deposits and ATM withdrawls will be charged at Rs 50 plus GST per transaction after free transactions according to the average monthly balance maintained.

The maximum cash deposit at a non-home branch per is Rs 2 lakh. The bank manager will have the discretion to accept more.