Bhubaneswar: As Odisha Chief Minister Naveen Patnaik completed four years of his fifth term in the high office, the state Cabinet on Monday approved the launch of a new housing scheme “Mo Ghara” to provide financial assistance for the lower and lower middle income households in rural areas.

Official sources said the scheme will cover all such families who were left out in the existing housing schemes due to stringent eligibility criteria or due to insufficient allocation and also those who had received housing assistance of smaller amount in the past and now wants to upgrade or expand their houses.

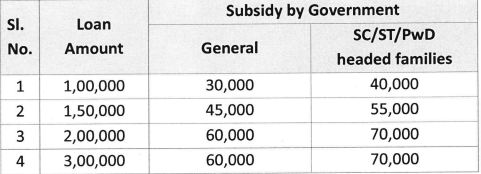

Under the ‘MO GHARA’ (Government Housing Assistance in Rural Areas) Scheme, a beneficiary can avail housing loan up to Rs 3 lakh which can be repaid in 10 years excluding 1 year moratorium period in easy installments. They can opt for one of the four slabs of the loan amount – Rs 1 lakh, 1.5 lakh, 2 lakh and 3 lakh.

The state government will bear the expenses of Rs 2150 crore for around 4 lakh beneficiaries over a period of two years for the scheme.

Eligibility Criteria:

The following categories of rural households will be eligible under this scheme.

-

- lf the family is staying in a kutcha house or one pucca room with RCC roof.

- lf the family has either not availed any Govt. housing assistance or has availed assistance of below Rs.70,000 /- in the past.

- lf the income of the family per month is below Rs.25, 000.

- lf the family does not possess a non-commercial motorized Four-Wheeler for personal use.

- !f the family does not have any member as a regular Government / PSU employee or drawing a monthly pension for the service period from Government / PSU.

- lf the family owns below 5 acres of irrigated land or below 15 acres non-irrigated land.

- State Government will release capital subsidy to the loan account of the beneficiaries on completion of the house. Enhanced capital subsidy will be available to the vulnerable categories like SC/ST and PWD headed households. The rates of the subsidy as decided by the State Cabinet today is as follows:

- The capital subsidy released to the loan accounts of the beneficiaries will result in significant reduction in EMI for repayment and thus make the repayment more affordable.

- Banks will not charge any processing fee from the beneficiary for sanction of the loan.

- ln order to further reduce the financial burden for the beneficiaries, the registration fee and stamp duties required during mortgage of tittle deed have been waived off by the State Government. The charges for getting certified copies of relevant documents from the Sub-Registrar offices as required by bank for processing of loan applications under this scheme will also be waived.

- The legal consultation fee is also standardized to Rs. 1000/- maximum, which State Government will reimburse to the banks.

- The beneficiaries can also avail support under relevant schemes of rural sanitation, drinking water, rural electrification etc. if found eligible and not availed earlier.

How the beneficiaries can avail the benefits of the scheme?

The government is launching a dedicated web portal (https://rhodisha.gov.in/moghara) for filing of online application, monitoring and implementation of the scheme.

The applicants will have to register in this portal before filing the applications which will be validated through OTP. The applications will be received through this portal from 16th June 2023.

The applicant can register either by her/himself or may use the services of Mo-Seva Kendra.

During filing of application, the applicant have to furnish information along with documents like Passport Size Photo and Aadhaar Card and KYC Document (Voter lD, PAN Card, Job Card, Driving License) & caste Certificate & PwD Certificate & lncome Certificate & Land record.

The applicant will invest a minimum of 10 % of loan amount as margin money either in shape of cash or kind or labor.

The applicant needs to have clear land tittle with land in Gharabari Kisam of Sthitiban Category. She/he will mortgage the tittle deed of the land and register at the concerned Sub Register office. Loan will be released in 2/3 installments on achievement of pre-defined stage of construction.

The beneficiary, if interested, can repay the loan amount earlier than the scheduled period of 10 years. They can also opt for paying higher EMls. No-prepayment charges will be imposed by bank for this period.

The guidelines of the scheme and other information are available at https://rhodisha.gov.in/moghara.