Mumbai: Following a sharp 9 per cent reduction in tariff on gold imports, the demand for the precious metal has surged significantly, causing international gold prices to surge to a lifetime high. Experts believe the demand for gold will remain strong due to the ongoing festival and wedding season.

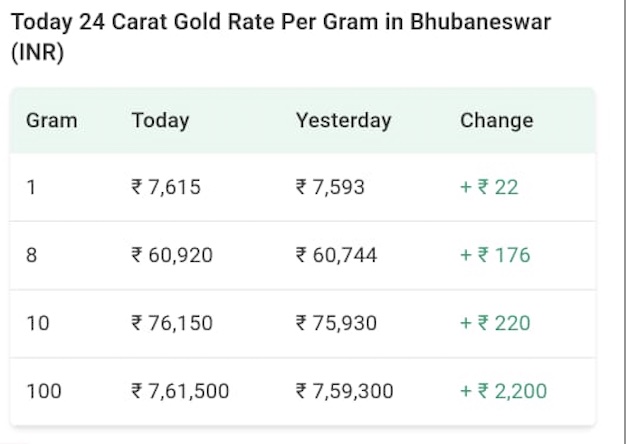

Last week, gold’s benchmark London spot price hit a lifetime high of $2599.2 an ounce. It is around Rs 76,582.43 for 10 grams, compared to Rs 76,000 per 10 grams in India. This surge in prices has been reported from Delhi, Jaipur, Lucknow, Chandigarh and Kolkata, according to Good Returns data.

In July, the government slashed the tariff from 15% to 9% on gold and silver to bring local prices higher than international prices, encouraging the smuggling of gold into India. A good monsoon, central bank buying, and the festive season keep gold prices up.

The US Fed interest rate cut by 50 basis points on September 18 and increased geopolitical tension has sent gold prices to record levels in the international market.

“The quarter of October, November, and December [this year] will perhaps be one of the most significant consumption quarters that we have witnessed in a long period of time,” Telegraph quoted Sachin Jain, chief executive of the World Gold Council’s Indian operations, as saying.

The primary beneficiaries of the duty cut are retail consumers, he added.

How Fed interest rate cut affects gold prices?

According to experts, when the Fed cuts interest rates, yields on interest-bearing assets like bonds and savings accounts fall. Thus, attractiveness of gold is increased since it doesn’t pay interest or dividends.

The rate cuts also tend to weaken dollars and gold being priced in dollars, becomes cheaper for investors possessing other currencies. This gives a boost to the metal’s global demand, increasing prices.

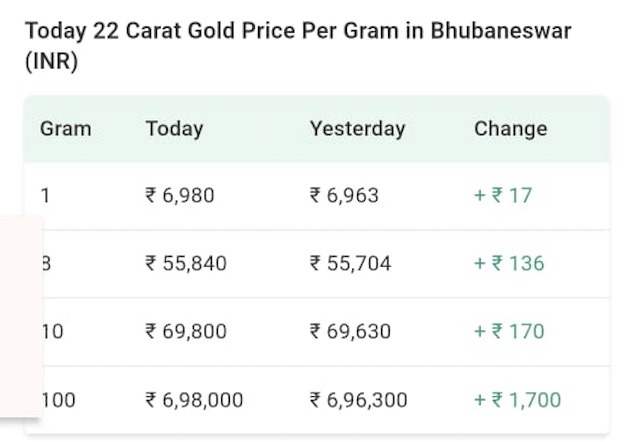

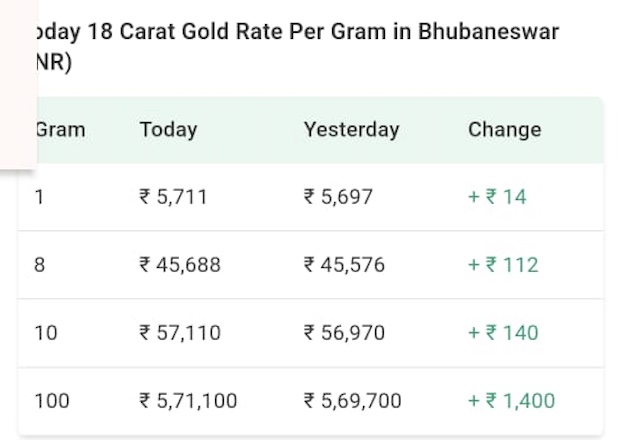

Check prices in Bhubaneswar