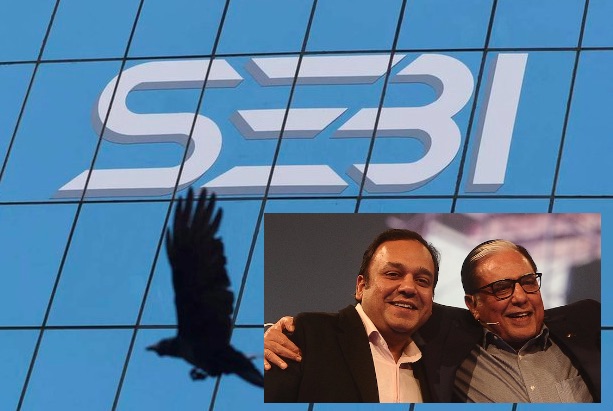

Siphoning Of Funds At ZEE: SEBI Bars Subhash Chandra, Punit Goenka From Holding Key Directorial Positions

Mumbai: Markets regulator Securities and Exchange Board of India (SEBI) has barred Chairman of Essel Group Subhash Chandra and Chief Executive Officer (CEO) of Zee Entertainment Enterprises Punit Goenka from holding any directorial or key managerial position in any listed company for siphoning off funds of the media firm for their own benefits.

“The Noticees (Chandra and Goenka) shall cease to hold the position of a director or a Key Managerial Personnel in any listed company or its subsidiaries until further orders,” the markets regulator said in 17-page interim order passed on June 12.

SEBI further noted that Chandra and Goenka alienated the assets of ZEEL and other listed companies of Essel Group for the benefit of associate entities, which are owned and controlled by them. It termed the siphoning of funds as a well-planned scheme, in some instances, as transactions involving as many as 13 entities were made within a short period of two days only.

An investigation into both parties started in November 2019 after the resignation of two independent directors of ZEE — Sunil Kumar and Neharika Vohra – from the board, citing various concerns including the appropriation of fixed deposits of ZEE by Yes Bank.

Chandra has issued a “Letter of Comfort” (LoC) on September 4, 2018, towards a Rs 200 crore loan outstanding Essel Group Mobility, which stated that the Rs 200 crore FD available with Yes Bank from any of the Essel Group companies, including Zee Entertainment, could be taken to settle it. Yes Bank has settled the loans of seven associate companies with this Rs 200 of ZEEL. These seven companies were owned by family members of Subhash Chandra and Punit Goenka, SEBI revealed.

While Zee Entertainment told SEBI that the amount has been returned in full between September 12, 2019 and October 10, 2019, the latter found that the returned money belonged to Zee and was routed via several other companies to show that it was being returned by associate companies. “”Noticees (Chandra and Goneka) created a façade through sham entries to misrepresent to the investors as well as the regulator that money had been returned by associate entities, whereas in reality, it was ZEEL’s own funds which were rotated through multiple layers to finally end in ZEEL’s account.”

The markets regulator also pointed out that the fall in the share price of ZEEL from around Rs 600 per share to less than Rs 200 per share during FY 2018-19 to FY 2022-23, despite the company being so profitable and generating profit after tax consistently, indicated that “all was not well with the company”. While the promoter shareholding dropped from 41.62 per cent to 3.99 per cent in ZEEL, Chandra and Goenka continued to be at the helm of affairs, the order noted.

“The noticees have attempted to ride piggyback on the success of ZEEL, the flagship company of Essel Group, to bankroll the associate entities, which are owned and controlled by them,” it said.

SEBI has asked ZEEL to place this direction before its board within 7 days from the date of receipt. It has also given both Subhash Chandra and Punit Goenka 21 days to file their reply or objections if any in the case.

The interim order has come as a blow for the company which is seeking regulatory approvals for a merger with Sony Pictures Networks India.

(With inputs from Outlook, The Mint & Rediff)

Comments are closed.