New Delhi: The name of Justice Yashwant Varma, a sitting judge of Delhi High Court at whose residence a pile of unaccounted cash was allegedly discovered on March 14, had figured in a Central Bureau of Investigation (CBI) FIR and an Enforcement Directorate (ED) ECIR when he was non-executive director of a company before being elevated as a judge of Allahabad High Court in 2014.

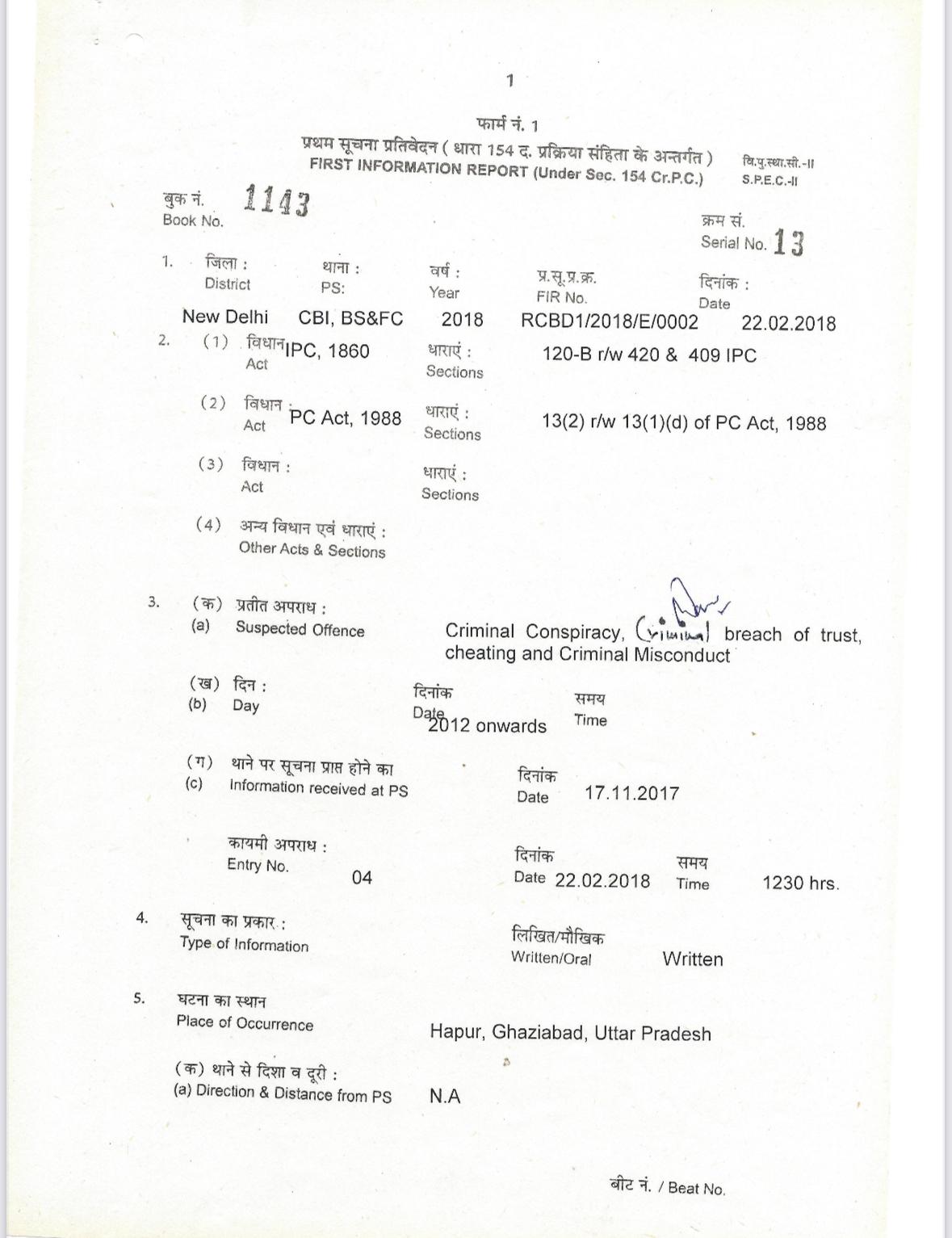

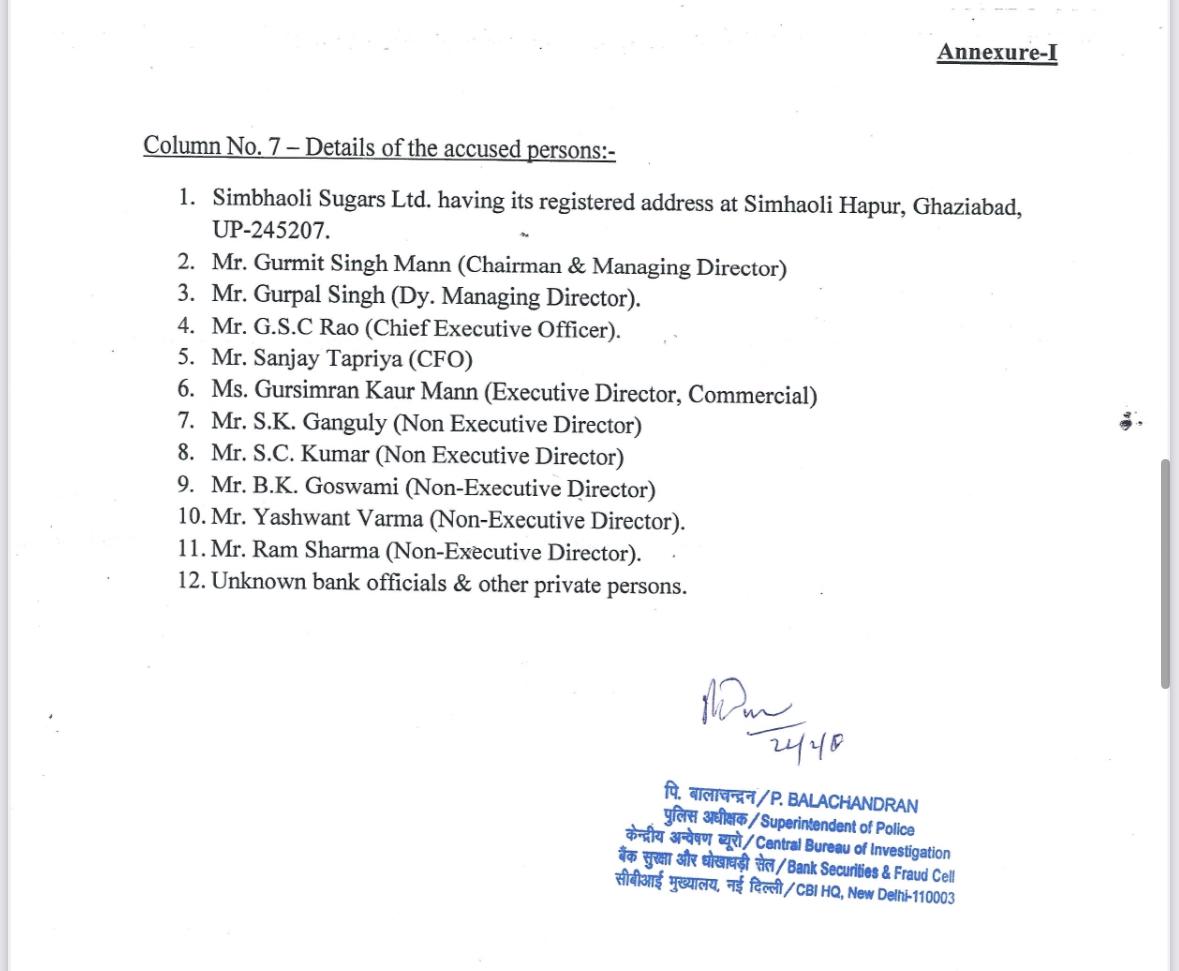

CNN-News18, which has a copy of the CBI and ED documents featuring Varma as an accused, reported that an FIR was lodged in 2018 by CBI, describing him as a non-executive director in Simbhaoli Sugar Mills in 2012 and listing him as ‘Accused number 10’.

The charge against Varma and the 11 others accused in the case is of criminal misconduct, cheating and criminal conspiracy.

However, the Supreme Court in 2024 set aside an Allahabad High Court decision to order a CBI inquiry into the Simbhaoli Sugar matter, CNN-News18 said.

Based on a complaint by the Oriental Bank of Commerce (OBC), accusing the sugar mill of defrauding the bank through a fraudulent loan scheme, Simbhaoli Sugar Mills, its directors, and others including Varma, were booked.

OBC claimed that between January and March 2012, the bank’s Hapur branch disbursed Rs 148.59 crore to 5,762 farmers to help them purchase fertilisers and seeds. Under the agreement, the funds were to be transferred to an escrow account and then distributed to personal accounts of the farmers. Simbhaoli Sugar Mills was the guarantor, committing to repay the loan and cover any defaults or identity fraud by the farmers.

However, the sugar company allegedly submitted false Know Your Customer (KYC) documents and embezzled the funds. OBC declared the loan a fraud in 2015, with Rs 97.85 crore being lost and a sum of Rs 109.08 crore outstanding.

Varma apart, another key figure named in the FIR was Gurpal Singh, the deputy managing director of the company who happened to be the son-in-law of then-Punjab Chief Minister Amarinder Singh.

Five days after the CBI FIR in February 2018, ED filed a complaint under Section 3/4 of Prevention of Money Laundering Act, 2002.

The Supreme Court last year said the high court had erred in ordering a CBI probe in the matter as no investigation was warranted. The apex court, however, added that authorities were not precluded from taking action for fraud in accordance with law.