Odisha Cabinet Nod To Waive Tax Arrear Upto Rs 5000; Other Decisions Here

Bhubaneswar: The State Cabinet on Tuesday took the decision to write off tax cases upto Rs 5000 under various Acts.

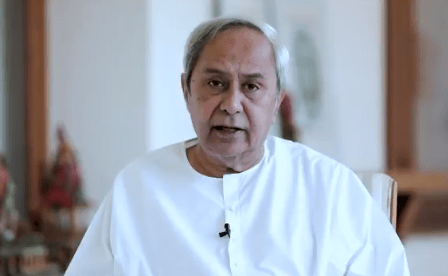

At the Cabinet meeting held under the chairmanship of Chief Minister Naveen Patnaik, it was decided that considering the impact of COVID-19 on the business and 34,332 arrear tax cases, arrear tax upto Rs 5,000 till the tax assessment period June 30, 2017 under OST Act, OAST Act, CST Act, OVAT Act and Odisha Entertainment Tax Act would be written off.

The Cabinet also approved a proposal to implement “Rejuvenating Watersheds for Agricultural Resilience through Innovative Development (REWARD)” project. It envisages an expenditure of Rs 500 crore on science-based watershed management for a period of six years starting from April, 2021. Out of this, World Bank will provide a loan assistance amounting to Rs 350 crore.

This would have a greater probability of generating higher yields, gross revenue, and net income. There will be 1 direct beneficiaries including 10,000 poor and landless households.

Following are other proposals approved by the Cabinet:

- A specific cadre rule i.e. “Odisha Small Savings & Financial Inclusion Service (Method of Recruitment and Conditions of Service) Rules, 2021”.

- Award the construction work of Bargarh Main Canal to the Larsen & Toubro Ltd at an amount of Rs 340.36 crore.

- Agricultural Produce and Livestock Marketing (Promotion and Facilitation)

Third Ordinance to ensure the farmers to realise optimum value return

of their produce and realize enhanced farm income. - Amendment of the Odisha Service of Auditors (Audit Officers) Amendment Rules, 2021 . A new post has been created as Chief Audit Officer-cum-Joint Secretary.

- With a view to giving independent focus and effort to Handicraft Sector and considering the similarities between Handloom and Handicraft Sector, the handicraft sector separated from the Industries Department and merged with Handlooms, Textiles & Handicrafts Department.

- Amendment of the Odisha Fiscal Responsibility and Budget Management Act, 2005. It will enable the government to meet higher resources requirement for COVID-19 management, maintain the standards of service delivery to the public, compensate the shortfall arising out of GST implementation (GST Compensation Shortfall), and maintain the level of Capital Expenditure on infrastructure projects in the State.

With the proposed amendment of the FRBM Act, the State Government

would be able to –

i. Avail additional fiscal deficit of 2% of GSDP during the financial year 2020-

21. This includes unconditional borrowing of 1% of GSDP and the balance

1% depending upon implementation of following four sectoral reforms,

each carrying weightage of 0.25%:

a. Implementation of One Nation One Ration Card System;

b. Ease of doing business reform;

c. Urban Local Body or Utility reforms; and

d. Power Sector reforms.

ii. carry forward unutilized borrowing ceilings availed during the financial

year 2020-21 to the next financial year,

iii. avail special borrowing under the Special Window towards the GST

Compensation Shortfall over and above the above relaxation, and

iv. avail additional fund in the forms of 50-year interest free loan under the

“Scheme for Special Assistance to States for Capital Expenditure” over and

above the above relaxation.

Comments are closed.