New Delhi: It was Finance Minister Nirmala Sitharaman’s eighth consecutive Budget, a record in itself. And it turned out to be a relief for the middle-class salary earners.

Sitharaman’s Budget speech, lasting 74 minutes, announced revised tax slabs, under the new regime.

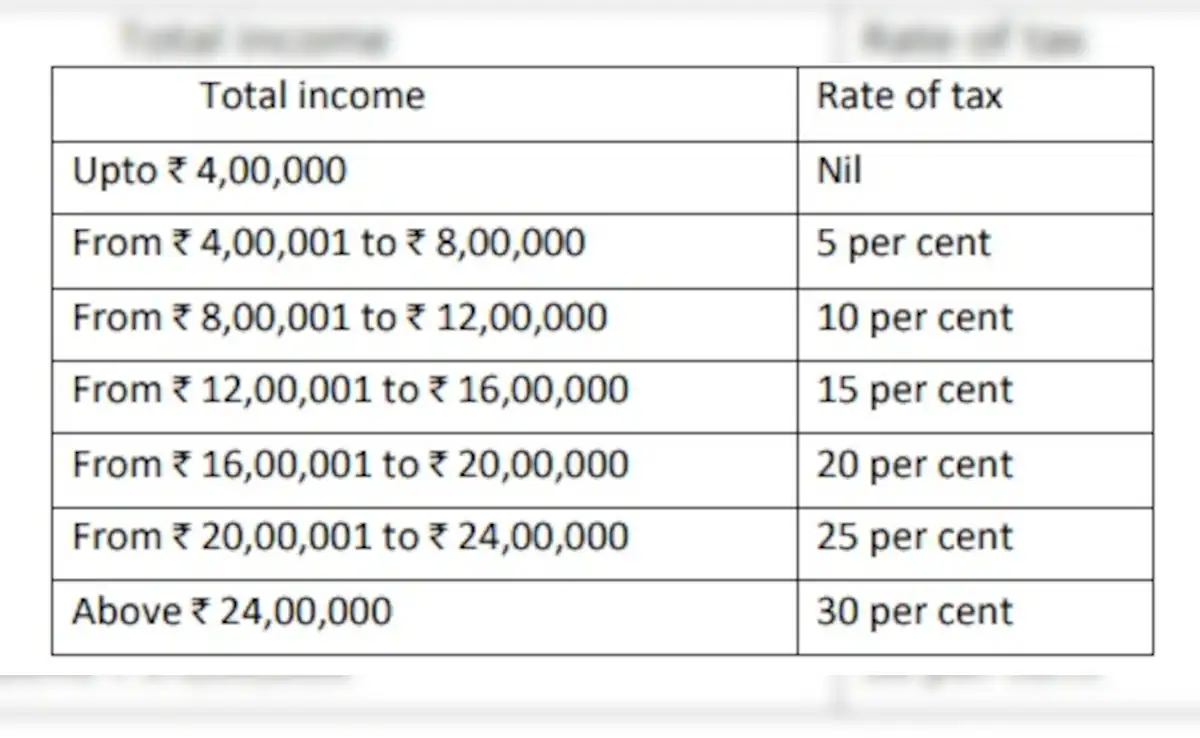

For annual income up to Rs 4 lakh, a salaried individual will pay zero tax.

CHANGED TAX SLABS

The zero-tax ceiling has been raised from Rs 3 lakh to Rs 4 lakh.

The 5 per cent tax bracket is now Rs 4 lakh to Rs 8 lakh, up from Rs 3 lakh to Rs 7 lakh earlier.

The 10 per cent tax bracket has been revised to Rs 8 lakh-12 lakh, from the existing Rs 7-10 lakh.

The 15 per cent tax bracket is now for those earning salary of Rs 12-16 lakh, compared to Rs 12-15 lakh earlier.

There will be a 20 per cent tax on those earning Rs 16-20, while individual with annual salary of Rs 20-24 lakh will be taxed 25 per cent

Income above Rs 24 lakh will attract a tax of 30 per cent.

HOW INCOME UPTO Rs 12 LAKH IS TAX-FREE

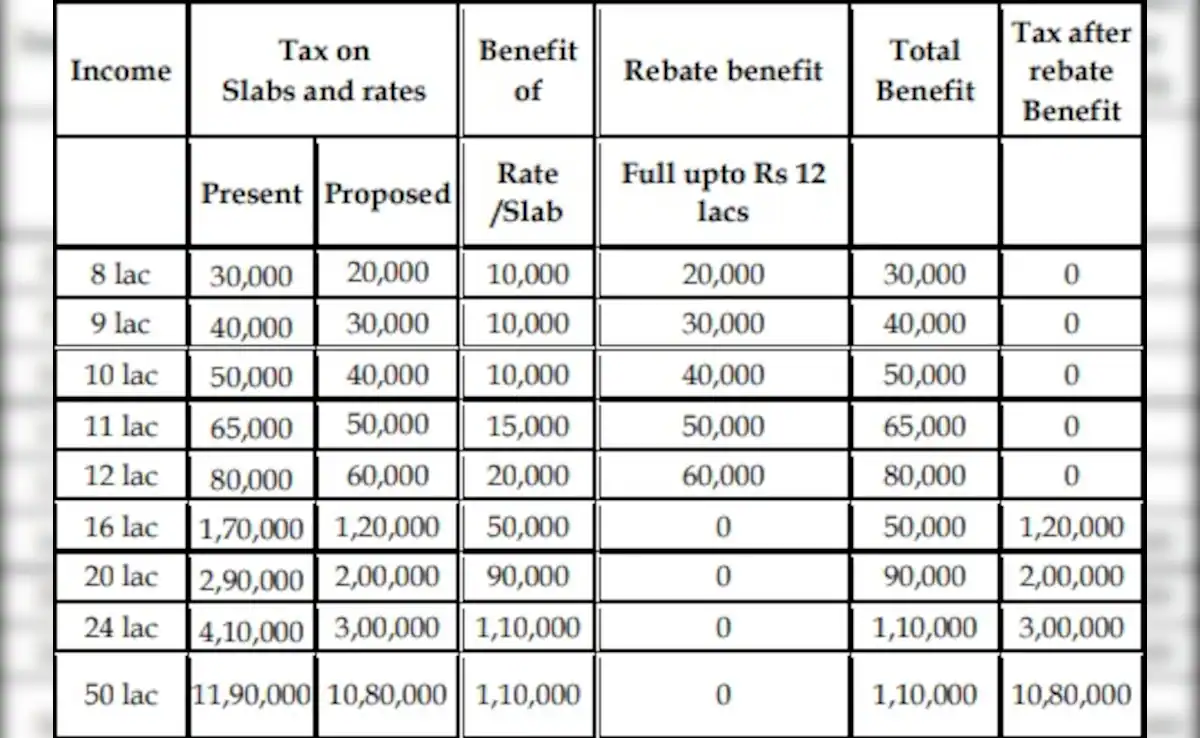

According to the Union Budget, the Central government will provide rebates to those earning up to Rs 12 lakh. For salaried individuals, the threshold will Rs 12.75 lakh, including standard deduction of Rs 75,000.

A table in the Budget document shows the government’s rebates — starting from Rs 10,000 for an income of Rs 8 lakh and going up to Rs 80,000 for an individual with a salary of Rs 12 lakh. The benefits are illustrated in the table.

TAX & BENEFIT ON SALARY OF Rs 16 LAKH PER ANNUM

For example, if a person has an annual income of Rs 16 lakh, here’s how much he or she will benefit from revised rates under new regime:

There will be zero tax up to Rs 4 lakh. In the Rs 4-8 lakh bracket, a 5 per cent tax will be levied which is Rs 20,000. In the Rs 8-12 lakh bracket, a 10 per cent tax amount to Rs 40,000. And in the Rs 12-16 lakh slab, 15 per cent tax will come to Rs 60,000. So, total tax to be paid is Rs 1,20,000 – which is Rs 50,000 less than what the person is currently paying.

TAX & BENEFIT ON HIGH-SALARIED PERSONS

In case of higher-salaried individuals, will they benefit under the new tax slabs? For example if an individual is earning Rs 50 lakh per annum, he will be paying income tax of Rs 10,80,000 as per the revised slabs — Rs 1,10,000 less than what he currently pays.

Hence, the revised slabs will put more disposable income in the hands of the middle and upper middle class group to boost consumption.

“Overall, the changes in slabs and related rates will benefit the middle-class and put more disposable income in their hands. The changes are not there in old tax regime which is in sync with the government’s intent to phase it out gradually,” Richa Sawhney, Partner, Walker Chandiok & Co LLP, told Financial Express.

OLD VS NEW REGIME

It may or may not be beneficial to switch from the old regime to new regime.

The decision will depend on the individual’s financial profile and how much exemption he/she can claim under old regime. If someone’s income is Rs 16 lakh per annum and he/she claims exemptions of Rs 4 lakh, the taxable income in that case will be Rs 12 lakh. According to old tax regime slabs, that person will have to pay income tax of Rs 1,77,500 — Rs 57,000 more than what under the new regime.